Schedule C Income Calculation Worksheet: A Guide to Accurately Calculate Your Business Income

If you are a self-employed individual or a small business owner, the Schedule C Income Calculation Worksheet can help you calculate your business income accurately. Read on to learn more about this essential tax form and how to use it effectively.

As a self-employed individual or small business owner, it’s important to accurately calculate your business income for tax purposes. The Schedule C Income Calculation Worksheet is an essential tool that can help you do just that. In this article, we’ll take a closer look at what the Schedule C Income Calculation Worksheet is, how it works, and how you can use it to calculate your business income accurately.

Free Worksheets Library Download and Print Worksheets from schedule c income calculation worksheet , source:comprar-en-internet.net

What is the Schedule C Income Calculation Worksheet?

The Schedule C Income Calculation Worksheet is a form that self-employed individuals and small business owners use to report their business income and expenses to the Internal Revenue Service (IRS). It’s part of the Schedule C (Form 1040), which is used to report income or loss from a business that you operate as a sole proprietor.

How does the Schedule C Income Calculation Worksheet work?

The Schedule C Income Calculation Worksheet is divided into several sections. The first section is where you list your income from your business. This includes income from sales, services, and any other sources related to your business.

Schedule C Excel Template Elegant event Staff Schedule Template from schedule c income calculation worksheet , source:penetratearticles.info

The second section is where you list your business expenses. This includes any expenses that you incurred in the course of running your business, such as rent, utilities, advertising, and supplies.

Once you have listed all of your income and expenses, you can use the worksheet to calculate your net income. This is the amount of income that you earned from your business minus the expenses that you incurred. Your net income is the amount that you will report on your tax return.

Credit Card Interest Calculator Excel Template Awesome 17 Awesome from schedule c income calculation worksheet , source:namicoeurdalene.org

Why is it important to use the Schedule C Income Calculation Worksheet?

Using the Schedule C Income Calculation Worksheet is important for several reasons. First, it can help you ensure that you accurately report your business income and expenses to the IRS. This can help you avoid penalties and fines for underreporting your income or failing to report all of your business expenses.

Second, using the worksheet can help you identify areas where you can potentially reduce your business expenses. By carefully tracking your expenses, you can identify areas where you may be overspending or where you can negotiate better rates with suppliers and vendors.

Finally, using the worksheet can help you better understand your business finances. By tracking your income and expenses, you can get a clearer picture of your overall financial health and make more informed decisions about your business.

How to Calculate Self Employment Tax in the U S with from schedule c income calculation worksheet , source:wikihow.com

How to use the Schedule C Income Calculation Worksheet

Using the Schedule C Income Calculation Worksheet is relatively straightforward. Here are the basic steps:

- Gather all of your business income and expense records for the tax year.

- Open the Schedule C form and locate the Income section.

- Enter your gross income from your business in the appropriate field.

- Locate the Expenses section and enter all of your business expenses in the appropriate fields.

- Subtract your total expenses from your gross income to calculate your net income.

- Transfer your net income to the appropriate field on your Form 1040 tax return.

Remember to keep accurate records of all of your business income and expenses throughout the year. This will make it easier to complete the Schedule C Income Calculation Worksheet and ensure that you report your income and expenses accurately to the IRS.

Self employment in e form main qimg startling it is the used from schedule c income calculation worksheet , source:prefabrikk.com

In conclusion, the Schedule C Income Calculation Worksheet is an essential tool for self-employed individuals and small business owners. By using this worksheet, you can ensure that you accurately report your business income and expenses to the IRS, identify areas where you can potentially reduce your expenses, and gain a better understanding of your overall business finances. If you need help completing the Schedule C form, consider consulting with a tax professional or using tax software to help you navigate the process.

It’s important to note that the IRS may require additional documentation to support the income and expenses that you report on your Schedule C form. Therefore, it’s important to keep detailed and accurate records of all of your business transactions.

Schedule C Car and Truck Expenses Worksheet Luxury Trucker Expense from schedule c income calculation worksheet , source:nativerevision.org

Additionally, it’s important to note that the Schedule C Income Calculation Worksheet is not the only tax form that you may need to complete as a self-employed individual or small business owner. Depending on the type of business you operate, you may also need to complete other forms such as Form 1099-MISC or Form 4562.

In conclusion, the Schedule C Income Calculation Worksheet is a critical tool for accurately reporting your business income and expenses to the IRS. By using this worksheet and keeping accurate records, you can ensure that you comply with tax laws, minimize your tax liability, and gain a better understanding of your overall business finances. If you have questions about how to complete the Schedule C form or need assistance with your taxes, consider consulting with a tax professional.

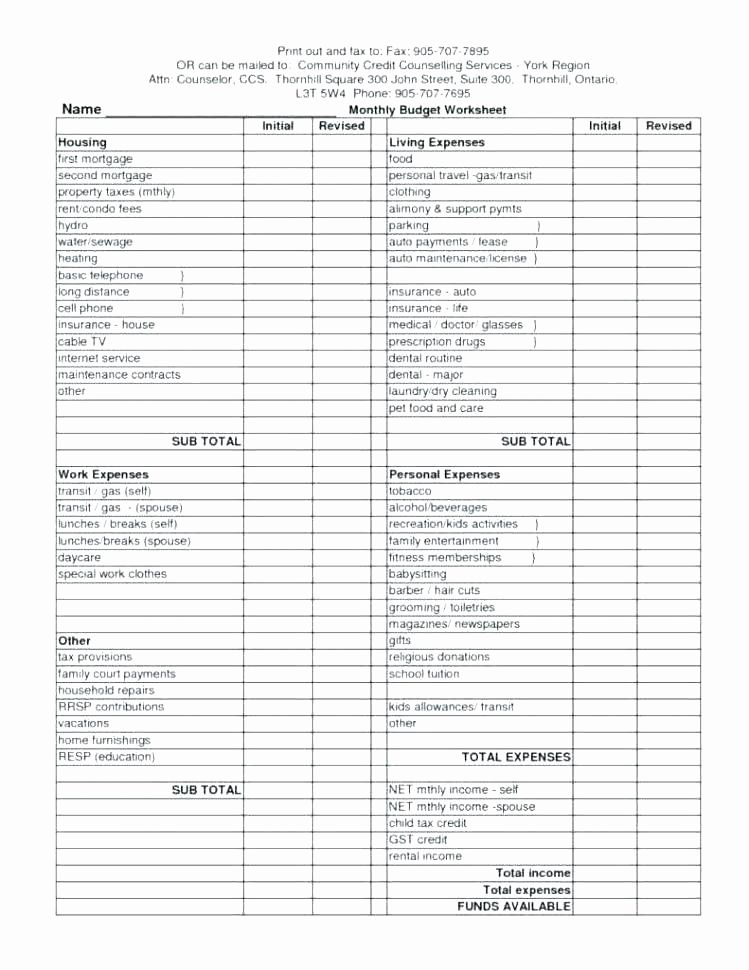

Business Expense and In e Spreadsheet from schedule c income calculation worksheet , source:duboismuseumassociation.org

23 New Receipt Calculator New from schedule c income calculation worksheet , source:speechandscript.com

In e and Expenses Template New In E and Expense Worksheet 35 from schedule c income calculation worksheet , source:penetratearticles.info

Schedule C Profit or Loss From Business from schedule c income calculation worksheet , source:thebalancesmb.com